US Healthcare Revenue Cycle Management

Revenue Cycle Management Services

M2ComSys has been a leading provider in revenue cycle management services to medical

practices. We partner with healthcare organizations to improve and accelerate reimbursements,

prevent denials, arrest revenue leakage, and improve the patient experience.

We leverage our team of industry veterans to ensure every aspect of the revenue cycle is

processed in the most efficient and effective manner possible. We help you get your revenue

cycle back on track, reducing costs and driving revenue.

Verification of patient Eligibility and Benefits

Our team is well versed in verifying the eligibility and benefits of patients telephonically, through insurance websites or IVR/IM systems provided by payers since it is imperative at the time of scheduling to gather as much information about the patient’s insurance carrier with which to verify benefits.

Charge Entry and Medical Billing

Our medical billing team has expertise electronic and paper claims submission help you bring in valuable revenue.

Payment Posting

We process the following types of remittance transactions with an exceptional degree of accuracy and timeliness:

- Electronic Remittance Advisory (ERA) Posting

- Manual Payment Posting

- Denial Posting

- Posting Patient Payment

Work Handled By Team

- Eligibility/Benefit Verification

- Prior Authorization

- Patient Demographics Entry

- Charge Entry

- Medical Billing

- Claim Rejection Management

- Payment Posting

- Denial Management

- AR follow-up (voice and non-voice)

- Credit Balance

Denial Management and AR Follow-up

Our AR voice and non-voice follow up teams analyze and perform timely follow-up on the outstanding balance in patient accounts, by making calls to insurance companies. We aim at reduction of ageing AR queues, thereby improving cash inflow and collection ratios of the customer. We review the patient records meticulously in order to address and rectify any denials from insurance.

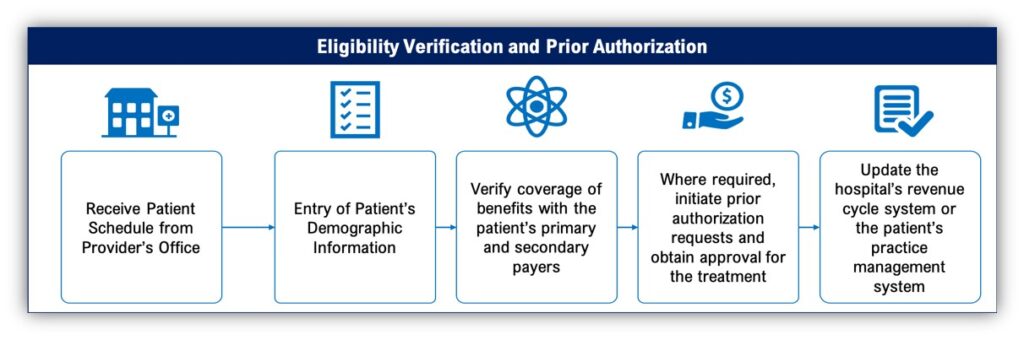

ELIGIBILITY VERIFICATION AND PRIOR AUTHORIZATION

The process of verifying benefits and eligibility of a patient(provided the benefits for the provider’s

specialty are available online on the insurance website) or telephonically via an IVR or a live

representative. It is imperative at the time of scheduling to gather as much information about the

patient’s insurance carrier with which to verify benefits.

Utilizing our referral and pre-authorization services confirms that the patient is approved for the

planned service or procedure before arrival, ensuring that the first stage of the revenue cycle is

completed accurately. Doing so sets the rest of the claims process up for success

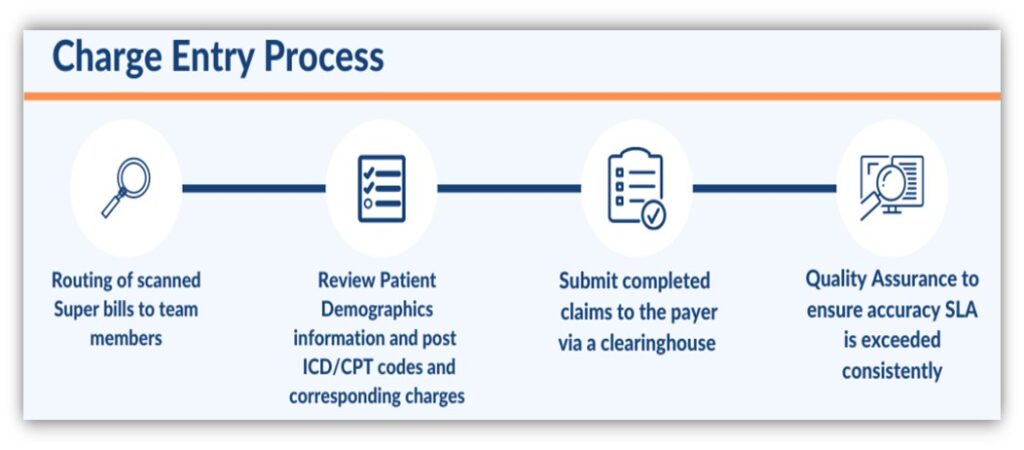

PATIENT DEMOGRAPHICS, CHARGE ENTRY AND MEDICAL BILLING

We deliver unmatched expertise in the claim submission process, starting from demo/charge entry

until the submission of claims electronically, through paper or via fax. Our charge entry team deals

with the billing work for major US healthcare providers. Every member of this team is trained in

medical transcription. This team takes care of assessment of doctor’s notes, interpreting them using

logical reasoning and a detailed knowledge about the latest ICD/CPT codes, calculating the costs,

and entering the charges for billing purposes

CLAIM REJECTION MANAGEMENT

Our edit resolution and claims experts navigate the electronic claims submission process to ensure

rapid payment of healthcare claims. Our services assist health organizations to:

- Assure clean claims are submitted for both primary and secondary health insurance claims

- Submit work comp and auto insurance claims with all pertinent information

- Ensure smooth integration with your patient accounting system

- Identify and correct incomplete claims

- Identify and locate missing attachments necessary for claims adjudication

- Reduce first pass claims denials

- Optimize collections by reducing denials or delayed payments

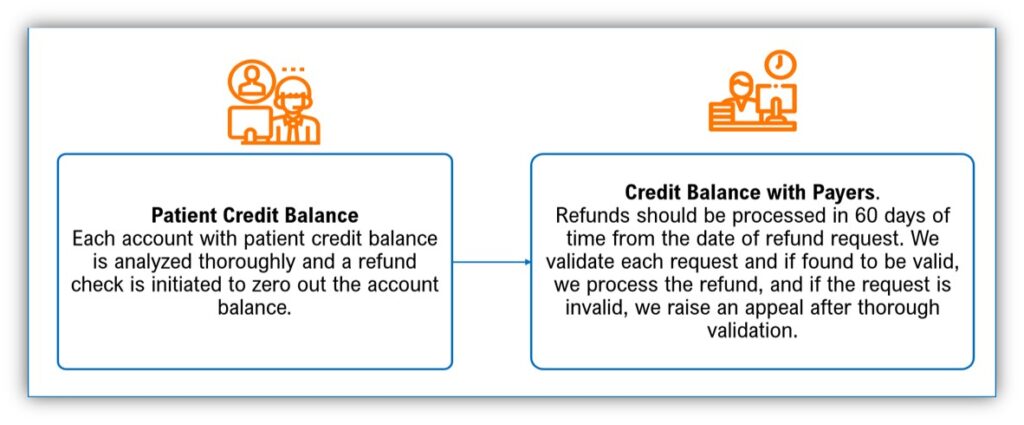

Credit Balance

Our team carefully reviews any overpayments and validate any other reason for credit balances on patient accounts thereby taking necessary action towards its resolution.

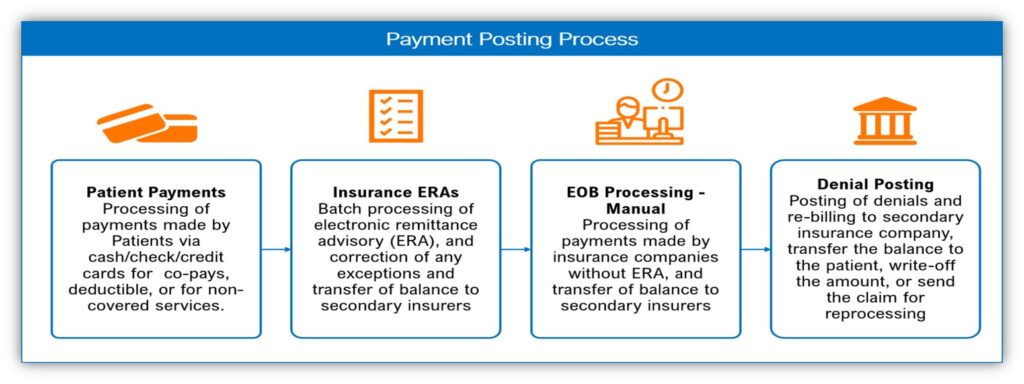

PAYMENT POSTING

The process involves recording payment details as received from the insurance company (in the form

of an EOB or an electronic remittance advice-ERA) and the patient. It is done in order to maintain a

record of the payments received and also to work on the denials/pending claims if any and the

necessary follow-up.

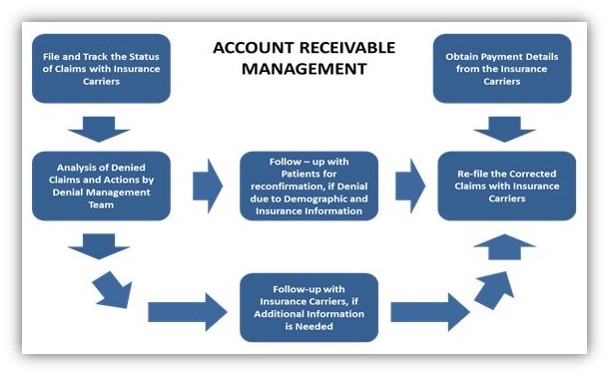

DENIAL MANAGEMENT AND ACCOUNTS RECEIVABLES FOLLOWUP

Our AR voice and non-voice follow up teams analyze and

perform timely follow-up on the outstanding balance in patient

accounts, by making calls to insurance companies. We aim at

reduction of ageing AR queues, thereby improving cash inflow

and collection ratios of the customer. We review the patient

records meticulously in order to address and rectify any denials

from insurance. Our specialties include:

- Focused approach toward account resolution & collections to minimize unnecessary follow-up.

- Utilize key performance indicators to identify operational nuances that can be used to streamline revenue cycle operations, minimize denials, and increase revenue.

- Provide timely follow-up and resubmission of claims to avoid timely filing limit scenarios.

CREDIT BALANCE

Revenue cycle credit balance review includes the identification and resolution of any credit balances that may have

occurred during a billing cycle. Credit balance review is required and regulated by law and helps clean up unnecessary

open accounts on your A/R. If accounts receivable reports have unresolved credit balances, it results in miscalculated

revenue reports and pulls necessary resources off vital tasks to correct the issue. Additionally, failing to reimburse

overpayments could potentially result in a fine, or worse, as multiple fines could result in serious financial noncompliance issues. These issues can be avoided by optimizing your revenue cycle and performing a thorough credit

balance review

FOR 15 DAY FREE TRIAL OPTION CONTACT US

Get In Touch

We make sure that each of our software we develop or apps we make are in the market, growing successfully, delivering satisfaction and ROI to our clients.